Financial coaching and support network

What truly sets HUB FinPath apart is our extensive network of certified financial wellness coaches. Your employees get personalized, unbiased guidance from specialists who can help jumpstart their path to wellness. Our coaches are not commission-based, so their advice is always focused on each participant’s success.

We offer a flexible, modern approach to financial wellness. Your employees can connect with a coach by phone, video chat or in person, ensuring that professional advice is always accessible.

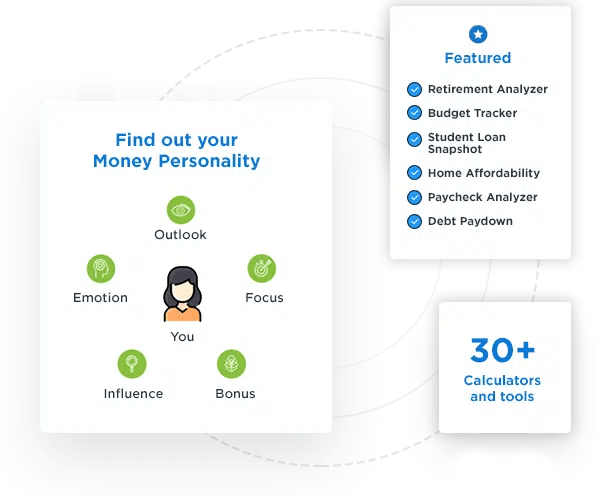

Financial health tools

HUB FinPath delivers a comprehensive suite of online tools designed to help employees actively manage their personal finances and make measurable progress toward their goals. By guiding them to build emergency savings, improve credit scores and reduce debt, HUB FinPath supports both individual financial wellbeing and a healthier, more focused workforce.

No matter the goal, employees can use HUB FinPath’s interactive tools to calculate how much they need to save and follow actionable steps to get there—turning intentions into achievable results.

Financial education for every level with HUB FinPath University

Whether your employees are new to personal finance or ready to take on more advanced topics, HUB FinPath offers a structured learning path that meets them where they are. Introductory 101 courses build foundational knowledge, while advanced sessions address complex topics with practical, real-world examples—making it easier for employees to make better financial decisions right away.

This year’s most popular courses include:

- 5 Tips to Maximize Your Paycheck

- Credit is a Powerful Financial Tool – Use it to Your Advantage

- Manage Your Debt or Your Debt Will Manage You

- Student Loan Forgiveness

Program Perks – Incentives that drive engagement

HUB FinPath’s rewards and perks program motivates employees to take meaningful steps toward improving their financial wellbeing. Through partnerships with select providers, participants gain access to exclusive resources, services and discounts—making it easier to stay on track and see tangible results.

Current perks include:

- Monthly cash drawings of $1,000 for active participants

- Student loan forgiveness evaluations

- Identity protection and credit monitoring discounts

- Debt consolidation and emergency loan options

- Nonprofit referral services for additional support

- More coming soon